Rebalancing Investment Portfolio

What’s Rebalancing of Investment Portfolio?

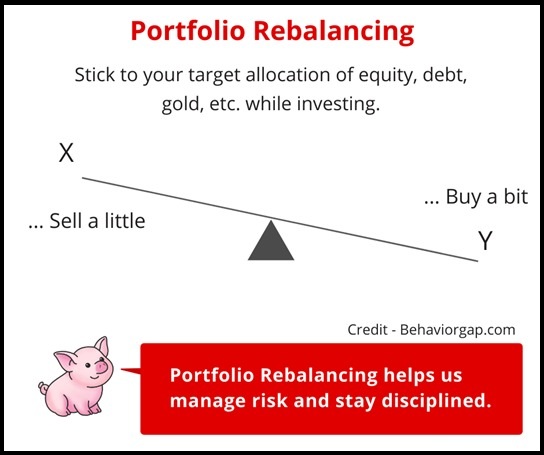

Rebalancing is the act of bringing one’s portfolio back to its desired asset allocation by taking profits out of certain outperforming investments and re-investing those returns in underperforming assets. It’s mainly done to bring down the risks in the portfolio. The right asset allocation will vary according to each investor’s unique situation and needs based on their risk tolerance and investing time horizon. It ensures to have a mix of investment assets usually stocks and bonds and cash appropriate to one’s risk tolerance and investment goals. It invariably tries to buy Equities or bonds when it is low and sells when the respective markets are high, to reduce the risks in the portfolio.

Ways of Rebalancing

Threshold-linked: Rebalancing is triggered when the asset mix deviates from the desired allocation by a predetermined percentage. Let’s say, the Asset allocation is fixed as 40 (Equity): 60 (Debt) and during the review of the portfolio with the bull rally in the Equity markets, the allocation gets changed to 70 (Equity): 30 (Debt), then rebalancing exercise would be taken up to bring back to the desired level of the desired 40 (Equity): 60 (Debt)

Time-linked: Rebalancing based on a pre-determined Goal schedule. Let’s say, a corpus of Rs.10, 00,000/- is required for Education Goal, then the aim of rebalancing exercise would be to bring back the portfolio to less riskier options one or two years prior to the Goal Period. When the goal period is shorter this kind of rebalancing helps to minimise the risk of volatility.

Cost of Rebalancing

Capital Gains Tax: Gains realised from selling equity investments within one year of investing are taxed at 15% (Short term capital Gain tax-STCG) and gains realised from selling Equity investments post a year of investment is long term capital gain and are taxed @ 10% over Rs.1 lakh per financial year. Debt investments sold within three years attract tax at the marginal rate (Short term capital Gain tax-STCG) and post three years at 20% with Indexation being Long term capital gain (LTCG).

Exit Loads

Mutual funds may levy exit load charges and may vary case to case if sold within the specified time limit.

Point to Note:

Frequent rebalancing will eat away your returns through high costs, and so remember to study the cost of Rebalancing before execution.

Advantages of Rebalancing

1. Brings discipline in Investment practice

2. Helps you to allocate your assets across different baskets

3. Helps you to maintain the desired asset allocation as per the Risk profile and the investment horizon

4. Helps you to stay and track your investments periodically

5. It keeps the risks under control

6. It ensures liquidity and flexibility in the portfolio

"LGF INVEST is an investment platform that offers curated investment opportunities in Finance and Real Estate with low investment and fixed returns.Enjoy a fully online investment experience with deal discovery, payments, KYC, documentation and portfolio management done securely and in partnership with best-in-class partners. The investment made by you and your co-investors in lgf invest converted as equity shares in our mother company KMK Infra Ventures Pvt.Ltd

This is for testing comment

Endemaj aspires to cultivate the evolving technological landscape by streamlining capital, thinking outside the box,and growing value on the back of our legal and financial expertise. Asset Management Companies in dubai As an investment house in Dubai, we look to identify and grow visionary ideas that have the potential to create a positive impact on a global scale.We are for the ambitious, the visionaries, the thinkers, the innovators.Investment House In Dubai Thanks